Homeowners Insurance in and around Walnut Creek

Homeowners of Walnut Creek, State Farm has you covered

Give your home an extra layer of protection with State Farm home insurance.

Would you like to create a personalized homeowners quote?

- Walnut Creek

- Lafayette

- Alamo

- Danville

- Pleasant Hill

- San Francisco

- Silicon Valley

- Oregon

- Arizona

- California

Welcome Home, With State Farm Insurance

Being a homeowner comes with plenty of worries. You want to make sure your home and the possessions in it are protected in the event of some unexpected damage or mishap. And you also want to be sure you have liability insurance in case someone hurts themselves on your property.

Homeowners of Walnut Creek, State Farm has you covered

Give your home an extra layer of protection with State Farm home insurance.

Safeguard Your Greatest Asset

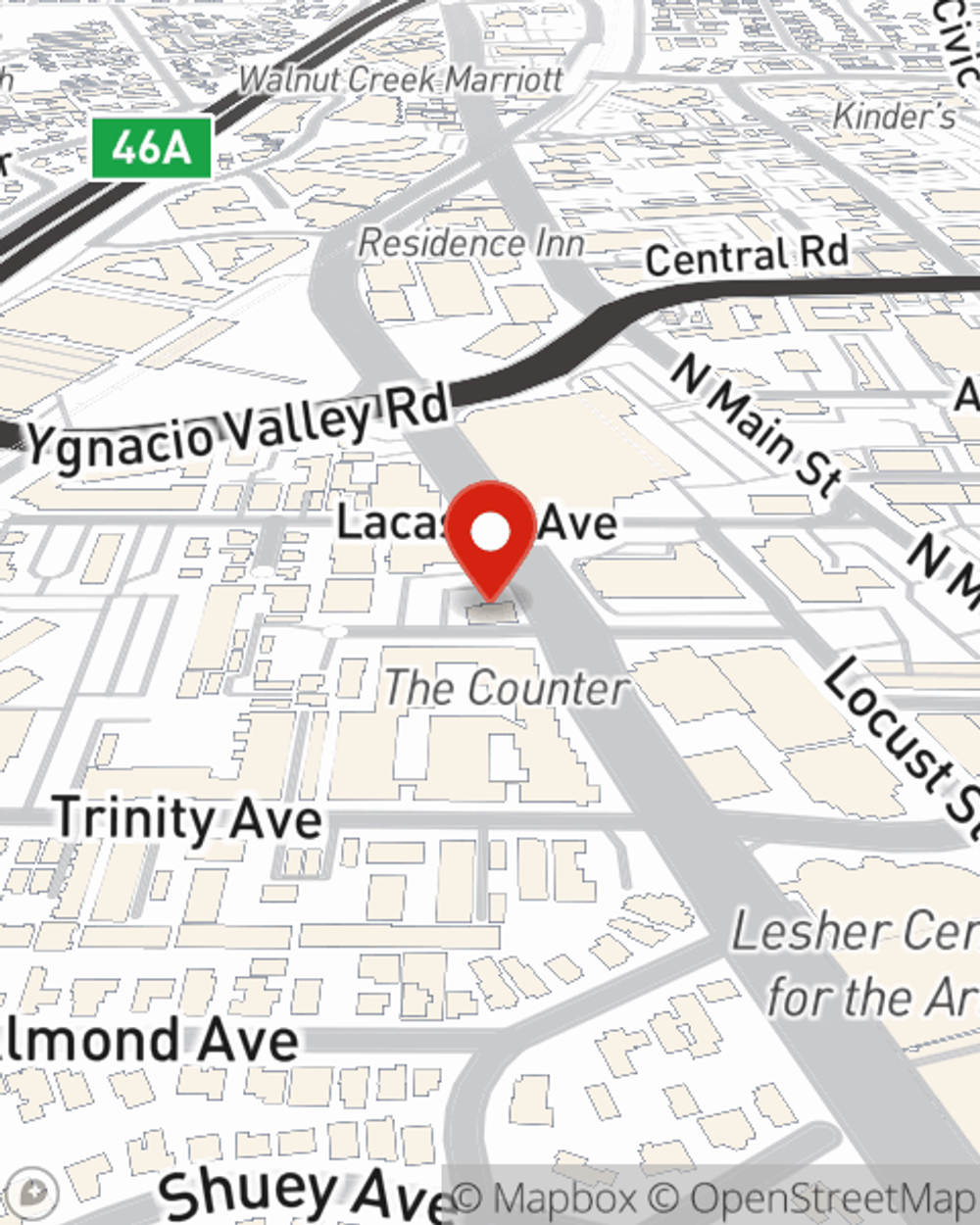

Outstanding coverage like this is why Walnut Creek homeowners choose State Farm insurance. State Farm Agent Sallie Severns can offer coverage options for the level of coverage you have in mind. If troubles like service line repair, sewer backups or wind and hail damage find you, Agent Sallie Severns can be there to help you file your claim.

As your good neighbor, State Farm agent Sallie Severns is happy to help you with getting started on a homeowners insurance policy. Visit today!

Have More Questions About Homeowners Insurance?

Call Sallie at (925) 945-1541 or visit our FAQ page.

Protect your place from electrical fires

State Farm and Ting* can help you prevent electrical fires before they happen - for free.

Ting program only available to eligible State Farm Non-Tenant Homeowner policyholders

Explore Ting*The State Farm Ting program is currently unavailable in AK, DE, NC, SD and WY

Simple Insights®

What are the different types of insurance?

What are the different types of insurance?

You can have more coverage than just car insurance, homeowners insurance, and life insurance. Learn about options for these and other types of policies.

Insurance terms simplified: the basics

Insurance terms simplified: the basics

Knowing your insurance basics can help you on your path to understanding your policy and coverage. Here’s some terms you’ll want to know.

Sallie Severns

State Farm® Insurance AgentSimple Insights®

What are the different types of insurance?

What are the different types of insurance?

You can have more coverage than just car insurance, homeowners insurance, and life insurance. Learn about options for these and other types of policies.

Insurance terms simplified: the basics

Insurance terms simplified: the basics

Knowing your insurance basics can help you on your path to understanding your policy and coverage. Here’s some terms you’ll want to know.